‘New rules should be established to close the regulatory gaps while at the same time providing more legal clarity and ensuring consistent application of the legislative framework across the Union. Equivalent operating conditions should be guaranteed, to existing and new players on the market, enabling new means of payment to reach a broader market, and ensuring a high level of consumer protection in the use of those payment services across the Union as a whole. This should generate efficiencies in the payment system as a whole and lead to more choice and more transparency of payment services while strengthening the trust of consumers in a harmonised payments market.’

The citation above comes from Directive (EU) 2015/2366 of the European Parliament and the Council of 25 November 2015 on payment services in the internal market. Market players refer to this directive as PSD2 (Payments Systems Directive 2). As stated in the directive, one goal of this directive is to drive the development of new means of payment.

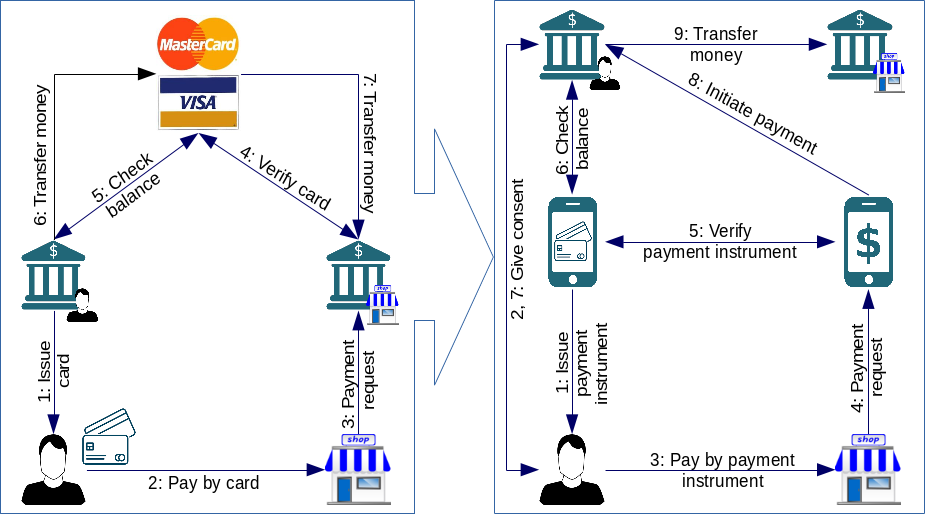

This article analyses the current card-based payment and a dream about a new means of instrument-based payment.

The payment instrument

Many players in the market use the word ‘instrument’ in place of a smart card, visioning the future, where the device used for payment may be anything, a card, a smartphone, a smartwatch, smart goggles, a smart coffee cup, a smart nail or even a smart chip under your skin. However, the device is only a small part of the payment. The system makes the difference—the system, what I’d call the mean of payment.

The current mean of card-based payment was established half a century ago. During this period, the system and the rules have been fine-tuned, and now a stable, robust, well-specified architecture supports millions of card-based payments per second worldwide. The Issuer Bank issues cards to the cardholder and associates those cards with the cardholder’s bank account. The cardholder uses the card at the point of sale. The merchant, which operates the point of sale, sends the payment request to the Acquirer Bank, where the merchant has an account. (Let’s forget about off-line transactions for a while for an easier example.) The Acquirer Bank asks the card scheme (Mastercard or Visa) to verify the card’s validity and check if sufficient funds are available for this payment. In case of a positive answer, the merchant accepts the payment. The Issuer Bank sends the requested money from the cardholder’s account to the card scheme (Mastercard or Visa), and the scheme sends the money to the Acquirer Bank, which credits the merchant’s account.

What may come?

To reach the goals of PSD2, new players may develop some new means of payment. I envisioned one in the picture of this article. In this scenario, the players are a bit different. Instead of large card schemes, new small players appear in the flow. If you are not familiar with the abbreviations players of PSD2, please have a look at my earlier “who’s who” article.

In this scenario, the PIISP (the smartphone with cards in the image) issues the instrument (card or anything else as seen above in this article) to the PSU (who is practically the card-holder). At this time, the PSU gives consent to their ASPSP (bank) that the PIISP may ask at any time if sufficient funds are available at the PSU’s bank account. On the other hand, the merchant selects a PISP (payment initiator) and registers an account where the money should be transferred.

The PSU pays by using the instrument at the point of sale. The merchant which operates the POS sends a payment request to the PISP. The PISP understands that the PIISP issued this instrument, so the PISP sends a verification request to the PIISP. The PIISP verifies if the instrument is available for payment, not expired, not a counterfeit instrument. Finally, the PIISP verifies if sufficient funds are available on the bank account of the PSU. Once the PIISP has given positive feedback to the PISP, the latter initiates the payment from the PSU account to the merchant’s account. During this payment initiation, the ASPSP of the PSU asks the PSU to give consent for this payment, prove their identity utilizing SCA (strong customer authentication). As soon as successful authentication has been finished, the money is transferred to the merchant and all parties are informed about the successful payment, so the merchant gives the goods to the PSU.

What is different?

As we can see, this new means of payment accelerates the payment from the merchant perspective. The value of the goods are available immediately or very soon. It makes a difference in the position of a merchant, as the merchant receives the value of the goods faster than today. However, this is true only in local transactions because international money transfers still may take several days.

From PSU’s point of view, this scenario is as convenient as today’s card-based transactions.

Banks may be the victims or beneficiaries of this new means of payment. They save some money that has been paid to card schemes, but they lose some incomes that they earned from the issuer or the acquirer business. The result depends on their current financial positions.

PIISPs and PISPs are now able to set up a new means of payment to compete with current systems. The future will show us how effective they can benefit from the opportunity. How fast, how secure and how convenient the new means of payment can be. How quickly they can reach the quality of today’s card-based payment. The race has started.