More than 20 years ago, I presented the advantages of the chip on a bank card compared to the magnetic stripe. Since then, EMV smart cards have become the preferred method in the card payment area. According to the articles, Mastercard will be the first to phase out magnetic stripe technology.

This decision gives new opportunities and new tasks to the players in the card payment.

The History

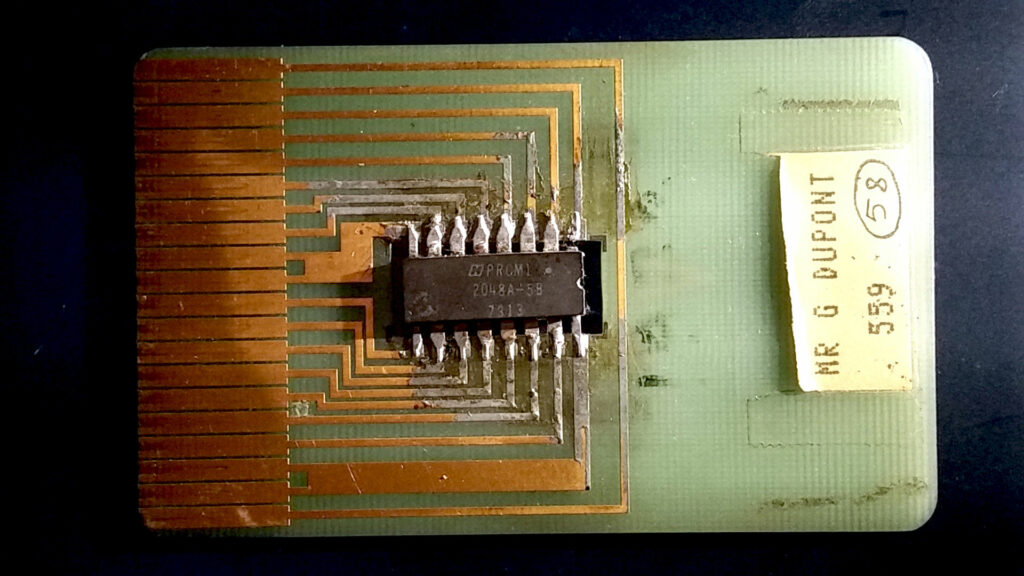

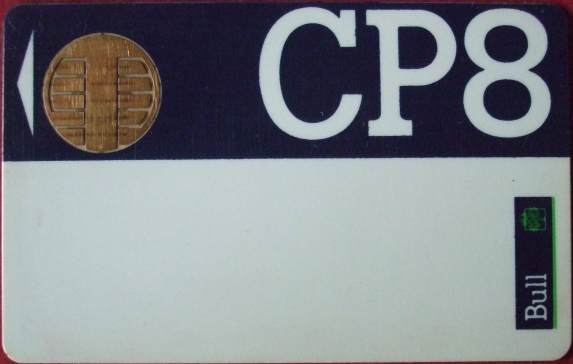

IBM invented the magnetic stripe in the 1960s. Although payment cards exited from the 1950s, those cards contained only embossed data. The invention of the magnetic stripe let issuers record data electronically on the cards. In the 1970s, a French inventor created the basis of the innovative payment device, and Bull brought to life the first operational microprocessor card, CP8.

The main advantage of the smart card technology against magnetic stripe was the more off-line transactions. Considering the telecommunication cost the availability of a reliable telecommunication network, banks operating in the US were less interested than those operating in Europe.

The early smart cards were manufacturer dependent. The protocol and the chip’s position were different, making it complicated to read cards from different vendors with the same card reader.

Finally, in the 1980s, ISO 7816 specified the position of the chip on the cards, as well as the electrical protocol. In the 1980s, French banks began to issue chip cards for payment purposes. For better interoperability, Europay, Mastercard, and Visa started working on EMV in the 1990s. Since then, practically all payment card schemes have joined to EMVCo.

Since the smart cards have more capability and the technology has enabled contactless payments, the magnetic stripe became a backup solution when the chip malfunctions.

Phasing out slowly

According to Mastercard articles, no card will have a magnetic stripe by 2033. Starting from 2024, Mastercard won’t require the payment card to hold a magnetic stripe. So, in the coming years, cardholders may begin to pay with such cards. A first step is only an option for issuers; the requirement will occur much later. Nevertheless, there may be other aspects to be considered. Issuers and acquirers should do analysis and tasks in this period.

Don’t block out your clients

In addition to the case when cardholders can’t enter a 24 hours area, as we discussed in our previous article, the ATM itself can block the cardholder.

Logically, self-service terminals try to protect themselves from inserting foreign objects that may cause malfunction. In many cases, the shutter control mechanism in an ATM verifies the presence of the magnetic stripe before opening the motorised card reader. This hidden feature may lead to strange complaints as the cardholder won’t understand why they can’t insert the card into the machine.

Service review

Removing the magnetic stripe seems to be a vendor task. The issuer bank orders only the card without stripe, and the vendor delivers it. Banks should review what services they pay for the perso-bureaus or the issuer hosts. As magnetic stripe is an old technology, the systems and the associated services were agreed upon tens of years ago. There might be some service that makes no sense anymore. Those services, without a review, may remain provided even though their results aren’t used anywhere.

If you want to analyse the impacts on your organisation, you can contact us, and we’ll help you understand the issuer’s or acquirer’s details. Our observing service helps you be always up-to-date.

Sources

- Swiping left on magnetic stripes [Mastercard]

- A Guide to EMV Chip Technology [EMVCo]

- ISO/IEC 7816 [ISO] (Printed)

- ISO/IEC 7816 [Wikipedia]

- Smart Cards History by Rick Chrabaszewski [DePaul University]

- Mastercard to end magnetic strip on cards [BBC]

- Shutter Control Mechanism Patent

- Images from pngtree.com

- Images from kindpng.com

- Photo from JLE consultants

- Photo from Wikipedia